A Business CaseMidom Solution

A Compelling Business Case

Enterprise integrity is assessed based on its appeal to stakeholders

compared to competing enterprises.

As a multi-dimensional risk-encompassing reputation, brand, social, environmental, and compliance factors—it is categorised as a 'risk of risks', primarily manifesting as a consequence of operational risk failures. The losses from such failures can be catastrophic, even fatal, making integrity risk largely immeasurable and unquantifiable.

A severe integrity risk event, which resulted in an $8 billion loss in value for an enterprise, stemmed from a sequence of four operational risk failures.

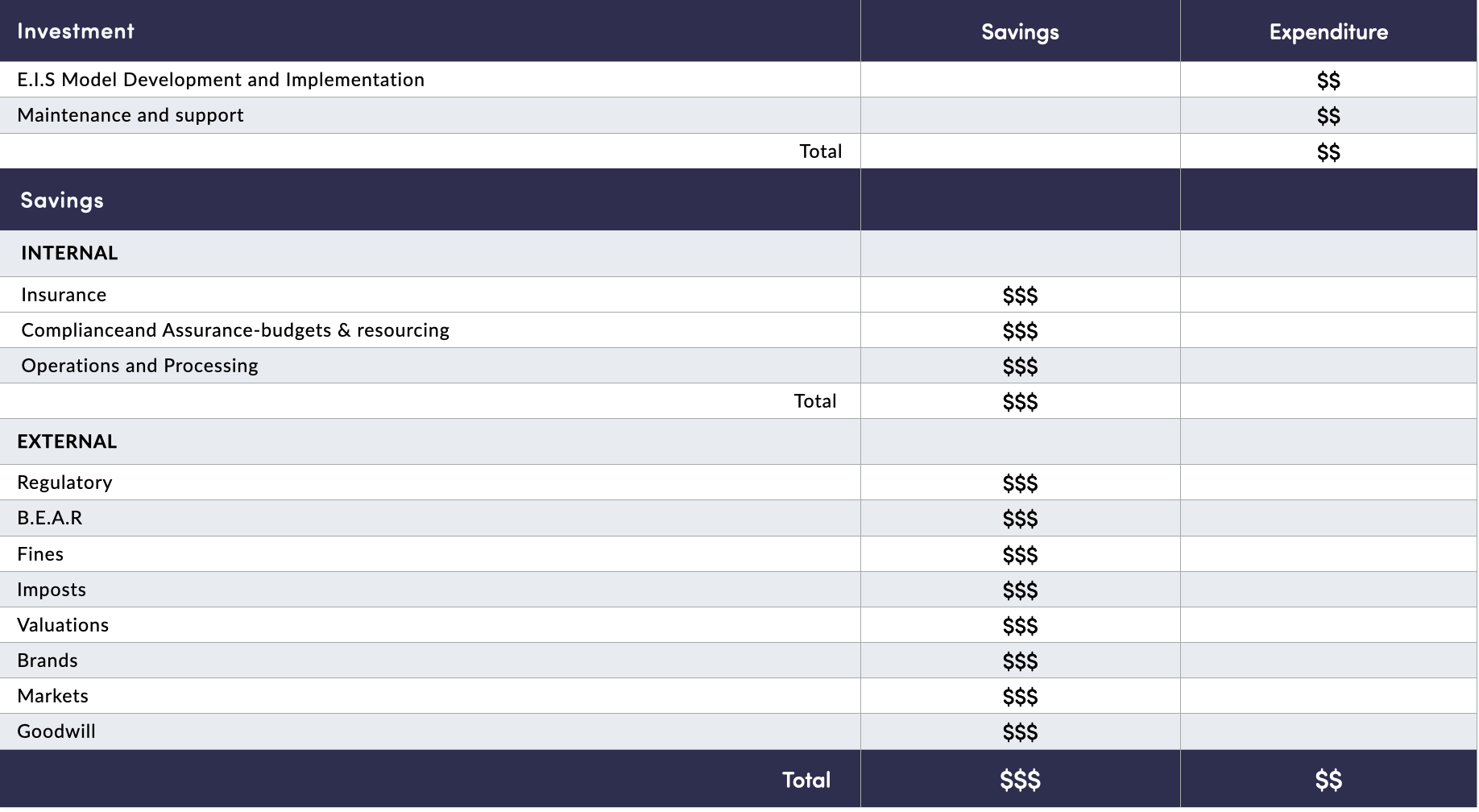

The Business Case For Implementing MIDOM Is Clear & Compelling

Making 2024 the optimal time to go digital.